118

Managing Medicine Stock and Expiry Tracking with Odoo ERP: A Pharmacy's Transformation

5 min read

118

5 min read

Table of Content

A five-location pharmacy chain operating across the dynamic hubs of Dubai and Abu Dhabi is a clear sign of growth, but it also means greater complexity. Business is thriving, but cracks begin to show in the most unexpected moments. Like discovering AED 15,000 worth of expired diabetes medication at 3 AM in the Jumeirah branch, tucked behind newer stock. The team insists FIFO protocols are followed, but the outcome tells a different story.

This isn’t an isolated incident. As the UAE’s pharmacy market is projected to reach a valuation of $8.15 billion by 2030, managing scale without compromising operational discipline is one of the toughest challenges for pharmacy owners (source). Every new location adds a layer of difficulty in maintaining inventory accuracy, regulatory compliance, and financial control.

The question that looms large: How can pharmacy chains continue to expand without losing their grip on the foundational systems that built their success?

The answer isn’t about working longer hours or hiring more staff — it’s about working smarter. This is where ERP (Enterprise Resource Planning) becomes not just a tool but a strategic differentiator. At BiztechCS, we’ve partnered with pharmacy networks across the UAE to streamline inventory, standardize operations, and future-proof their scalability. Time and again, one insight becomes crystal clear: inventory management must evolve from being a routine function into a competitive advantage.

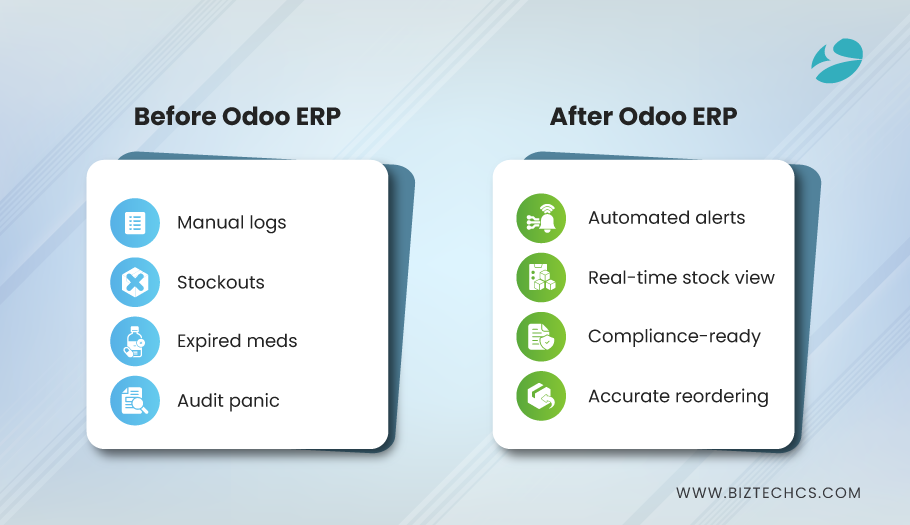

When we audit pharmacy operations, we consistently find the same expensive blind spots. Take our recent client assessment in Abu Dhabi: a six-location chain was hemorrhaging AED 8,000 per month due to preventable expiries. Not because their staff was careless, but because their systems couldn’t talk to each other.

Their setup looked familiar—separate POS systems, Excel spreadsheets for expiry tracking, and a procurement process that relied on gut instinct rather than data intelligence. Sound familiar?

The real question isn’t whether you’re losing money to expired inventory—it’s how much you’re losing that you don’t even know about.

We discovered that pharmacy teams across developed markets spend 1-2 hours daily just sourcing alternatives due to inventory visibility gaps. In the UAE context, where regulations from the DHA and MOH require precise traceability, this inefficiency compounds into a serious operational risk.

Consider this: When your pharmacist in Dubai can’t see that your Sharjah location has excess stock of a slow-moving medication, both locations suffer. Dubai over-orders, Sharjah writes off expired stock, and there are double charges for the same error.

If those reflect operations in your pharmacy, then you are not alone. Every successful pharmacy chain reaches an inflection point where manual systems that previously worked become its limitations for growth. Let’s discuss how strategic ERP implementations can transform such challenges into competitive advantages.

The transformation begins with understanding that modern pharmacy management isn’t just about managing inventory—it’s about orchestrating information flow to make intelligent decisions automatically.

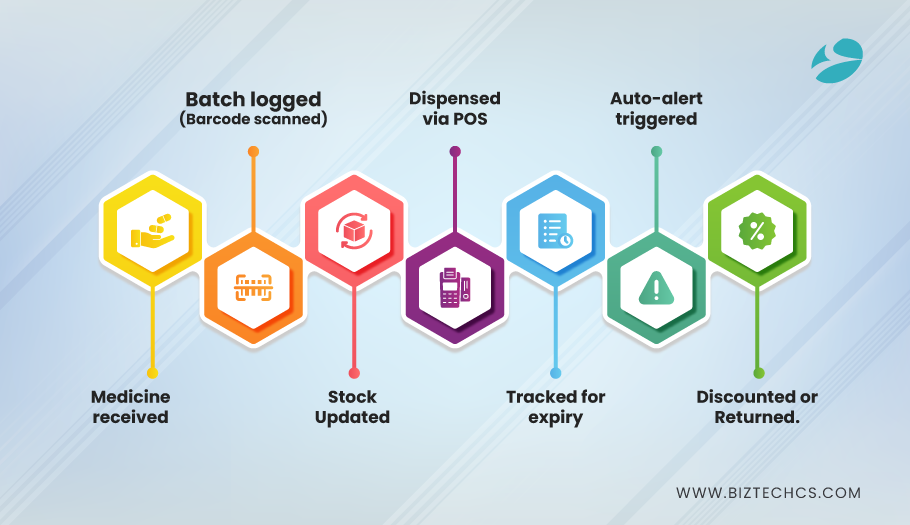

Here’s where most pharmacy technology fails: alerting you that medication expires in 30 days isn’t helpful if you don’t know what to do with that information. Odoo’s batch and lot tracking goes deeper, automatically calculating whether that 30-day window is sufficient based on your location’s velocity patterns.

We recently implemented this for a Dubai pharmacy group where slow-moving medications were consistently expiring at their premium locations while their volume locations ran stockouts. The system now automatically suggests inter-location transfers before expiry becomes a problem.

The real breakthrough isn’t just knowing when medications expire—it’s having the system suggest what to do about it before it becomes a problem.

Every pharmacist knows FIFO principles. However, enforcing them across multiple locations, with rotating staff and unpredictable customer patterns, requires more than just good intentions. That’s why implementation matters.

We configure Odoo to enforce FIFO automatically using barcode-based workflows. When stock is received, staff can’t accidentally shelve new items ahead of older ones. And when prescriptions are filled, the system defaults to suggesting the oldest suitable batch.

The goal isn’t to train staff to follow FIFO — it’s to make FIFO the path of least resistance.

The results? Our Abu Dhabi client achieved a 48% reduction in expiry-related write-offs in just six months, not through better training, but through the implementation of more intelligent systems.

The real power emerges when your inventory system thinks like a network rather than individual locations. When your Dubai Marina pharmacy dispenses the last unit of a critical medication, your system should instantly know which other locations have stock and can handle overflow demand.

We implement this through Odoo’s integrated POS and inventory modules, creating what we call “intelligent stock awareness.” Your pharmacists don’t just know what they have—they know what the network has and can serve customers accordingly.

Why does this matter? Because in the UAE’s competitive pharmacy landscape, customer experience often determines loyalty. The pharmacy that consistently fulfills prescriptions wins long-term relationships.

Curious about how this level of integration might work with your existing systems? Every pharmacy chain has unique requirements, and understanding yours is where meaningful transformation begins. Let’s explore your specific setup and discuss preliminary possibilities.

Implementation success hinges on one fundamental principle: the system must feel natural to pharmacy professionals, not IT professionals. This is where our approach differs from traditional ERP deployments.

Phase 1: Understanding Your Business Rhythm

Before we touch any software, we spend time understanding the unique rhythms of your operation. How do seasonal medications move through your network? Which locations have different customer patterns? Where do your current processes actually work well?

This isn’t just data collection—it’s discovering the business intelligence that needs to be embedded in your new system. Every successful implementation builds on what is already working, rather than replacing everything.

Phase 2: Configuration That Reflects Reality

This is where implementation experience becomes critical. We don’t just enable Odoo features-we deploy them yet customized to your business logic. If your high-volume location has different reorder points from your boutique pharmacy, the system should reflect that intelligence accordingly.

It’s often the details in these configurations that separate a good implementation from a great one-made easy for your team to feel intuitive.

Phase 3: Validation Through Real Scenarios

We validate the system through actual pharmacy workflows: receiving shipments with mixed expiry dates, handling customer returns, managing promotional stock, and processing DHA reporting requirements. This phase determines whether your team will embrace or resist the new system.

The intention is not to prove that the system works, but to demonstrate that it works better than what they are currently doing.

Phase 4: Gradual Rollout and Optimization

We generally start at your most operationally stable location, optimize workflows, and then proceed to other branches. This allows us the luxury of refining our domestically based solutions on actual usage scenarios before implementing a complete rollout.

BiztechCS Implementation Insight: “Don’t try to solve every problem in version one. Start with core functionality that delivers immediate value, then expand capabilities based on user feedback and confidence.”

“How do we know this won’t disrupt our daily operations?”

This concern reflects wisdom, not hesitation. Any system change carries risk, which is why our implementation methodology prioritizes stability above speed. We run parallel systems during transition, validate every workflow before going live, and maintain support presence during the critical first weeks.

The bigger risk is continuing with systems that are already failing to scale with your growth.

“Will our staff actually use this, or will they work around it?”

User adoption is the ultimate measure of implementation success. We design workflows that feel natural to pharmacy professionals because if your team doesn’t trust the system, the system can’t deliver value.

Our experience shows that when the system makes their job easier rather than more complex, adoption happens organically. The key is a configuration that matches their thinking patterns, not forcing them to adapt to software logic.

“Can we afford the implementation cost and time investment?”

This question usually stems from viewing ERP as a cost center rather than a revenue enabler. Our Abu Dhabi client recovered their entire implementation investment within eight months through reduced write-offs and improved inventory turns alone.

The better question is: Can you afford to continue scaling operations without intelligent inventory management?

Naturally, these concerns are essential to have. Every successful implementation starts with honesty about risks and realistic expectations. We can offer some suggestions to address your situation, aiming to minimize implementation risk and thereby increase business value.

Let’s set some measurable outcomes into conversation: the UAE pharmacy industry remains a dynamic growth sector, with the retail pharmacy market estimated at $8.62 billion in 2024 and forecasted to reach $10.4 billion by 2032. This growth presents opportunities, but only for operations that can scale wisely.

What we consistently see in successful implementations:

The gains are not merely the pursuit of efficiency; they instead become competitive advantages that mature as the network grows.

A strategic insight: Any pharmacy that experiences intelligent inventory management, while its competitors use manual methods, does not simply operate efficiently; instead, it captures disproportionate market shares during a period of rapid growth.

The transformation journey leads to a more fundamental change in how you think about your business. With intelligent and automated inventory management, the focus shifts away from operational firefighting toward strategic growth planning.

Instead of worrying about whether you have stock, you’re analyzing which products to add to your formulary. Instead of managing individual location performance, you’re optimizing network-wide efficiency. Instead of reacting to regulatory requirements, you’re proactively exceeding them.

This is the difference between running a pharmacy chain and scaling a healthcare business.

The UAE’s dynamic healthcare market rewards this strategic approach. With government reforms reducing medication costs by up to 30% and digital health initiatives accelerating, the pharmacies that master operational intelligence will capture the greatest share of market growth.

The fundamental question isn’t whether to transform your operations—it’s whether you’ll lead that transformation or be forced to follow it.

Every UAE pharmacy chain reaches this decision point: continue scaling with systems that worked when you were smaller, or invest in infrastructure that can grow with your ambitions.

At BiztechCS, we understand this decision because we’ve guided dozens of pharmacy chains through exactly this transition. We know that implementation success depends not just on technical capability, but on understanding the unique pressures and opportunities in the UAE pharmacy market.

Our approach begins with a simple principle: we implement technology that makes your business stronger, not just more automated.

What sets our methodology apart:

● UAE market expertise: Deep understanding of local regulatory requirements and customer expectations

● Pharmacy-specific focus: Industry configurations that reduce implementation time and risk

● Proven implementation process: A phased approach to drive disruption even further while ensuring maximized value.

● Long-term partnership: Ongoing support that will evolve with the growth of your business.

All product and company names are trademarks™, registered® or copyright© trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.